Apple Card has generated quite the buzz since its March 2019 announcement. The iPhone maker's new credit card pairs with Apple Wallet on your device, is simple to sign up for, includes enhanced security over other cards, has zero fees, and provides daily rewards right to your Apple Cash account. And as good as that sounds, the fine print can complicate things real quick.

First of all, it's important to clarify that Apple Card isn't an Apple-exclusive product. While using the card appears to be a uniquely Apple experience, the company partnered with Goldman Sachs and Mastercard for its credit card project. You might think those partnerships don't matter to you and the way you use your Apple Card, but it does. In fact, your iPhone could already disqualify you from using Apple Card, before it even hits the market.

- Don't Miss: The Fees, Limits & Fine Print of Apple Pay Cash

That's not to say all the rules and regulations are necessarily bad news. While some keep a tight grip over Apple Card users, some cool features benefit cardholders as well. We cover both kinds in our list below.

1. You Basically Need an iPad or iPhone

If you're rocking an Android device, yet want to take advantage of your Apple Card account on your phone, you'll sadly be out of luck.

You can add a Card to your Eligible Devices, but you must maintain a Required Device with a digital Card to manage your Account electronically. Without a Required Device, you will only be able to manage your Account by contacting [Goldman Sachs] by phone or mail, and your Monthly Statement will only be sent to you by email or mail.

Goldman Sachs defines a "Required Device" as an iOS or iPadOS device that runs an OS compatible (which would be 12.4 or higher) with Apple Card. That means that Android devices are not eligible for electronic account management.

If you sign up with an iPad or iPhone, then get rid of the device, you may be able to use your physical titanium card. However, doing so will provide very challenging since there is no credit card number, expiration date, CVV, or signature on the card itself. All of that data is stored in Apple Wallet, and if you no longer have Apple Wallet, the card is pretty much useless. The card itself is only meant as a supplement "physical" card for stores and restaurants that do not support Apple Pay.

Also, all future account management must take place with Goldman Sachs directly via phone or mail. And Goldman Sachs will only send your monthly statements via email or snail mail. Kind of a bummer for a card that's made to work on mobile.

That's not the worst of it, though. Goldman Sachs maintains that, unless you have a "Required Device," they may close your account entirely. So if you ditch iOS for Android, there's a good chance Goldman Sachs will cancel your card so you can only make payments. The only way to guarantee full service is to use Apple Card with an iPad or iPhone. If that isn't realistic for your situation, you'll need to hope the three companies work something out beyond Apple devices in the future.

2. You Can't Jailbreak

We love a good jailbreak tweak over here at Gadget Hacks. Goldman Sachs, however, does not. In its Terms & Conditions, the company lays out its expectations regarding modification of your "Required Device."

If you make unauthorized modifications to your Eligible Device, such as by disabling hardware or software controls (for example, through a process sometimes referred to as "jailbreaking"), your Eligible Device may no longer be eligible to access or manage your Account. You acknowledge that use of a modified Eligible Device in connection with your Account is expressly prohibited, constitutes a violation of this Agreement, and could result in [Goldman Sachs] denying or limiting your access to or closing your Account as well as any other remedies available to [Goldman Sachs] under this Agreement.

Basically, don't jailbreak. If Goldman Sachs identifies your iPhone as jailbroken, it has every right to block or close your account. Our advice? See if you can score yourself a secondary iPad or iPhone to run your jailbreak experiments on. You can jailbreak up to iOS 12.2 now, so there should be a vast pool of devices out there eligible for jailbreaking.

- More Info: Jailbreak iOS 12 to iOS 12.2 on Your iPhone

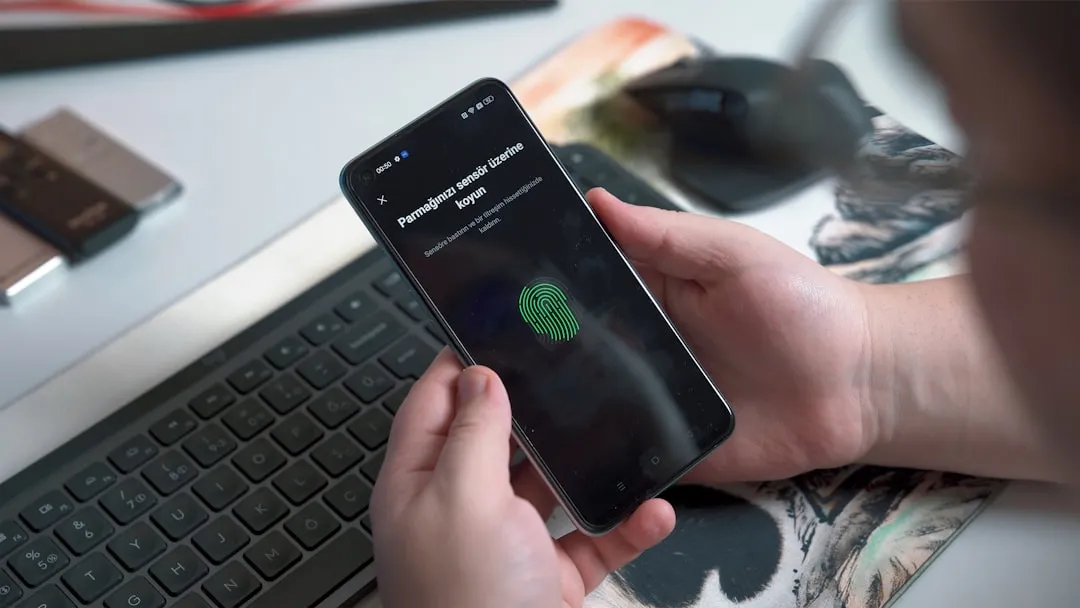

3. You Need Two-Factor Authentication Enabled

In order to set up an account with Goldman Sachs for Apple Card, you need to enable two-factor authentication (2FA) on your Apple ID.

To be eligible for and to maintain an Account, you must ... have Apple's two-factor authentication turned on for your Apple ID that is associated with your iCloud account.

If you already have this feature enabled, great. If not, it doesn't take long to set up. Check out our guide on Gadget Hacks to get started.

4. It's for US Customers Only Right Now

According to Apple's support page, Apple Card is only available for citizens or lawful resident of the US that have a US address that's not a P.O. Box. Also, you must be 18 years or older. The US resident part may change in the future, but don't expect the age requirement to.

To get Apple Card, you must ...

- Be 18 years or older, depending on the state you live in.

- Be a U.S. citizen or a lawful U.S. resident with a U.S. residential address that is not a P.O. Box. If you're a U.S. citizen, you can also use a military address.

5. Goldman Sachs Can Change or End 'Daily Cash' at Any Time

Daily Cash is a compelling reason to get an Apple Card. The program offers three tiers for cash-back rewards on purchases:

- 3% on purchases made directly through Apple, including in stores, online, on the App Store, and in apps.

- 2% on purchases made using Apple Pay.

- 1% on all other purchases.

That said, Goldman Sachs reserves the right to change or end the program at any time for any reason. While the company could change the program for the better, it could also change it for the worst. Make sure to take advantage of the promotion while you can.

[Goldman Sachs] may change the requirements, amounts, transaction categories, redemption process, frequency of redemptions, or any other aspect of the Daily Cash program at any time. We reserve the right to end the Daily Cash program at any time for any reason.

6. That 3% Back Is Only for Purchases Directly from Apple

It already states it above, but if you buy from "Apple" on Amazon or any other third-party retailer, you will get either the 2% or 1% back as described above. Unfortunately, these exemptions also apply to Apple authorized resellers. Bummer.

You will not earn 3% Daily Cash for purchases of Apple goods and services that are sold through third party retail or online stores, including any Apple authorized resellers, or if you make your payment through a third party wallet.

7. You Don't Need an Apple Cash Card for Daily Cash

To spend all that Daily Cash you earn from purchases, you need an Apple Cash card account. But it's not entirely necessary. If you don't have or want one (it's provided with other partnered banks, not Goldman Sachs), you can use your Daily Cash as "payments" on your Apple Card account. You just have to make those payments manually, whereas Daily Cash into your Apple Cash card is automatic.

- Don't Miss: What You Need to Get Started with Apple Cash

If you do not have an Apple Cash account that is active and in good standing, or any attempted transfer to your Apple Cash account fails for any reason, [Goldman Sachs] will not make Automatic Transfers of your Daily Cash, and any Daily Cash you earn will accrue without Automatic Transfer.

- If you have an accrued but unredeemed Daily Cash balance, you can use the Wallet app to redeem all of your accrued but unredeemed Daily Cash as a credit to your Account. Daily Cash redemptions as a credit to your Account are considered payments.

- If you later establish an Apple Cash account that is active and in good standing, then any accrued but unredeemed Daily Cash balance will be transferred to your Apple Cash account no later than your next posted Purchase Transaction, and Automatic Transfers will begin with your next posted Purchase Transaction.

If you have an accrued but unredeemed Daily Cash balance at the time your Account is closed, [Goldman Sachs] will automatically apply that balance as a credit to your Account, unless prohibited by law, in which case [Goldman Sachs] will pay you the amount of the Daily Cash balance via electronic funds transfer or by sending you a check.

8. Goldman Sachs Can Change Your Credit Limit at Any Time

According to the fine print, Goldman Sachs can change your credit limit any time it wants to. Usually, a credit company will raise your credit limit if you prove to be a responsible debtor at your current limit and lower your limit in the opposite case. It's safe to say that's what Goldman Sachs means here, but the language does give it the right to change your limit at any time, for any reason.

[Goldman Sachs] may increase or decrease your credit limit at any time, subject to applicable law.

[Goldman Sachs] may authorize Transactions that, together with previously authorized Transactions, interest and other amounts billed to you, cause your outstanding balance to exceed your credit limit. If [Goldman Sachs does], you will be responsible for paying that amount.

9. Goldman Sachs Can Deny a Transaction at Any Time

Similarly, Goldman Sachs can stop a transaction at any time, for any reason. Most likely, the company will stick to denying transactions on the grounds that it violates one of the company's agreements or that you've exceeded your credit limit. But it's important to know that Goldman Sachs reserves this right 24/7 for any purchase you attempt to make.

[Goldman Sachs] may decline Transactions for any reason, including suspected or actual fraud, violation of applicable law, your default under this Agreement, or if you exceed your credit limit. [Goldman Sachs is] not liable to you or anyone else if [Goldman Sachs does] not authorize a Transaction, even if the charge is within your credit limit or you are not in default. If [Goldman Sachs declines] a Transaction, [Goldman Sachs] may advise the person who attempted the Transaction that it was declined. [Goldman Sachs is] not responsible if anyone refuses to accept your Card.

10. You Can't Buy Cryptocurrencies

If you're into buying Bitcoin, Ethereum, Litecoin, and other cryptocurrencies, you cannot buy any with your Apple Card. You can use other credit cards to buy crypto from apps such as Coinbase, just don't attempt to use Apple Card.

You may use your Account to make Transactions. You may not use or permit your Account to be used for ... Cash Advances and Cash Equivalents.

While that quote is a little ambiguous, elsewhere in the Goldman Sachs' terms it states:

"Cash Advance and Cash Equivalents" means any cash advance and other cash-like transaction, including purchases of cash equivalents such as travelers checks, foreign currency, or cryptocurrency; money orders; peer to peer transfers, wire transfers or similar cash-like transactions; lottery tickets, casino gaming chips (whether physical or digital), or race track wagers or similar betting transactions.

11. No Fees on Foreign Purchases

Making a purchase abroad? Don't worry about it. Goldman Sachs doesn't charge a fee on purchases made outside your home country. Instead, the company converts the cost of the item to US dollars. The only catch is Goldman Sachs outsources the work to Mastercard, who will convert on the day the transaction processes. That means the conversion may be different than the day you bought the item.

Transactions made in a currency other than U.S. dollars will be converted into U.S. dollars. [Goldman Sachs does] not add any foreign exchange rate fee to these Transactions. The conversion will be performed by Mastercard International, the payment network associated with your Account (the "Network"). The Network follows its own methods for conversions that are subject to change. The conversion will occur on the day the Transaction is processed by the Network, which may be different than the date of the Transaction. As a result, the conversion rate may differ from the rate as of the Transaction date or the date the Transaction is posted on your Account.

12. Your Apple Card Comes with a Variable APR

Any interest you accrue while making purchases with Apple Card will be determined by a variable APR. Unlike a fixed APR, which uses the same percentage each month to determine the amount of interest you owe, a variable APR can change month-to-month. Not only that, Goldman Sachs might offer you a different APR for different purchases you make.

When you first open your account, Goldman Sachs will offer you a 12.99% to 23.99% APR, based on creditworthiness. Apple claims "Apple Card's goal is to provide interest rates that are among the lowest in the industry," but being a goal and a fact are not the same thing. Later, the APR will change based on the Prime Rate, published daily by the Wall Street Journal.

If you start with a 12.99% rate, there's a good chance it may end up becoming 18.99% or worse a few years from now.

For Purchase Transactions, the APR equals the Prime Rate plus the Margin that applies to your Account.

Variable APRs may increase or decrease each month if the Prime Rate changes. Your Purchase Transactions APR is a variable rate. If the Prime Rate changes, the new variable APRs will take effect as of the first day of the next month and apply to existing and new balances. Any increase in the Prime Rate may result in an increase to your interest and Minimum Payment Due. APRs will never exceed the maximum rates permitted by applicable law.

The "Prime Rate" in effect for a given month is the highest U.S. Prime Rate published in the "Money Rates" section of print edition of The Wall Street Journal (WSJ) on the last day of the prior month that the Prime Rate was published. If the WSJ does not publish the Prime Rate on that day, then [Goldman Sachs] will look to the last day before then that such rate was published. If the WSJ temporarily or permanently discontinues publishing the Prime Rate in its "Money Rates" section or if the WSJ changes its definition of the Prime Rate, then [Goldman Sachs] may substitute another publicly available index not within [Goldman Sachs'] control and adjust the Margin, in [Goldman Sachs'] sole discretion, subject to applicable law. However, for the month of August 2019, the Prime Rate is equal to the U.S. Prime Rate published in the "Money Rates" section of the print edition of The Wall Street Journal (WSJ) on August 2, 2019.

13. You Can Split Bill Payments Between Apple Cash & a Bank Account

Apple Card gives you options when it comes to paying the credit card bill. One of those options allows you to split a payment between your Apple Cash balance and a bank account of your choosing. If your Apple Cash balance covers the whole amount, Goldman Sachs will only take money from that account. However, if there isn't enough in Apple Cash, the rest of the payment will fall on your bank account.

You can choose to "split" your electronic payment between your Apple Cash account and your bank account. If you elect to do so, funds will first be taken from your Apple Cash available balance, and if such funds are insufficient to pay off the full payment amount that you have authorized, then [Goldman Sachs] will withdraw the remaining funds from your designated bank account. You agree that [Goldman Sachs] may receive information about your Apple Cash account from the Apple Cash provider for purposes of supporting split payments.

14. You Can't Buy Anything Illegal

This one should be a given, but in case it's not, here you go.

You may not use or permit your Account to be used for ... any illegal purpose, including in connection with unlawful domestic or international gambling websites or to purchase illegal goods or services.

Don't buy anything illegal. Don't give your Apple Card to anyone to buy something illegal. Basically, be a good citizen, and stick to the law when using Apple Card.

15. Goldman Sachs Has Never Given Credit Cards Before

In Apple's recent press release, it reiterated that Apple Card is Goldman Sachs' first foray into credit cards, something we've known for over a year now.

As a newcomer to consumer financial services, Goldman Sachs is creating a different credit card experience centered around the customer, which includes never sharing or selling data to third parties for marketing and advertising.

Since there is no history to go off of, there's no telling how the company will perform for its customers. Goldman Sachs has been in the personal loan lending business, for sure, but credit cards are a whole different ballpark. While it touts the fact that it will never share or sell your data, there's no guarantee "never" means never forever. And we'll just have to see how all of the things go above as time moves on.

Cover image by Apple/YouTube

Comments

Be the first, drop a comment!